WELCOME TO

INSTITUTE OF CHARTERED ACCOUNTANTS, GHANA

Be A CA (Chartered Accountant) Be A Business Leader.

- Annual Conference

- Members

- Students

- College

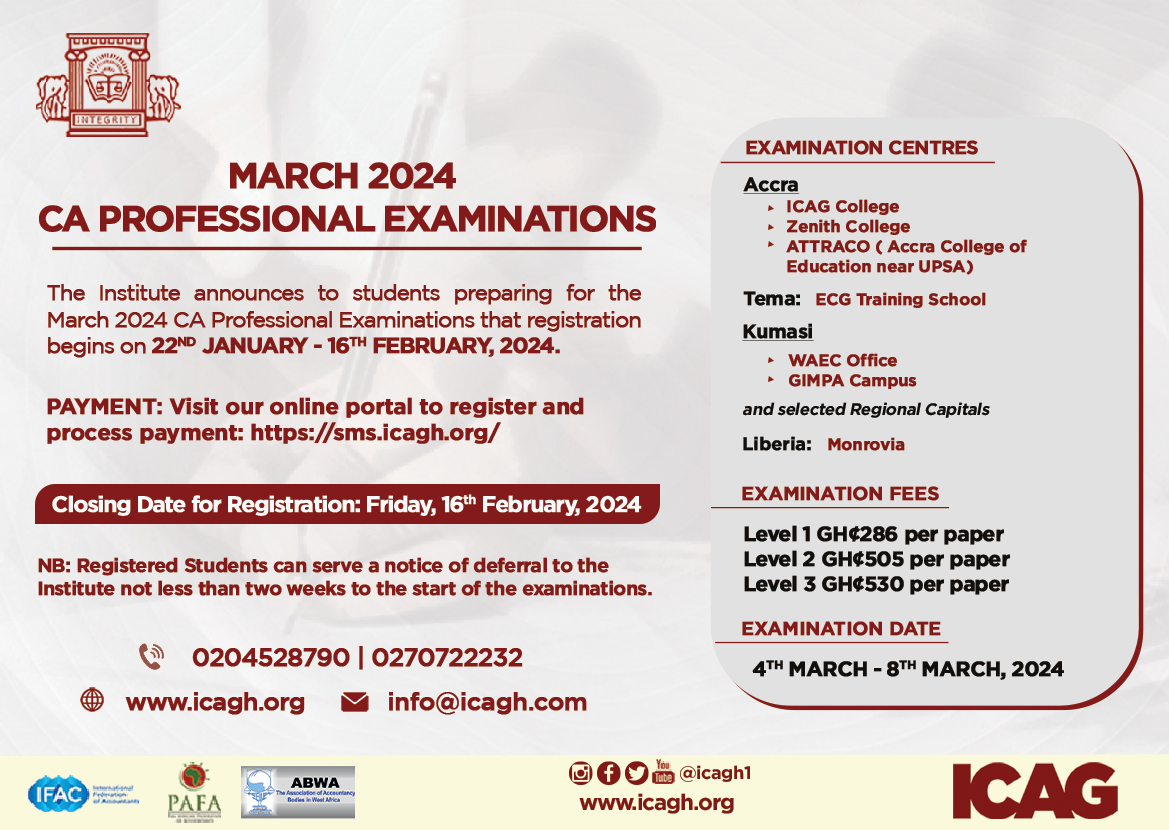

- Exams

- Publications

no images were found

Adoption of International Financial Reporting Standard (IFRS 17)

Industry Consultation Paper on the Ghana Domestic Debt Restructure Programme (V4-Clean)

ICAG Directive on Classification of T-Bills

The Release of IFRS Sustainability and Climate-related Disclosure Standards - IFRS-S1 and IFRS-S2

3rd ICAG Paper on the Ghana Domestic Debt Restructure Programme (V5)

2nd ICAG Submission to BOG on Accounting Implications of GDDE Programme (1)

Form Submission is restricted

Form is successfully submitted. Thank you!

Media Center

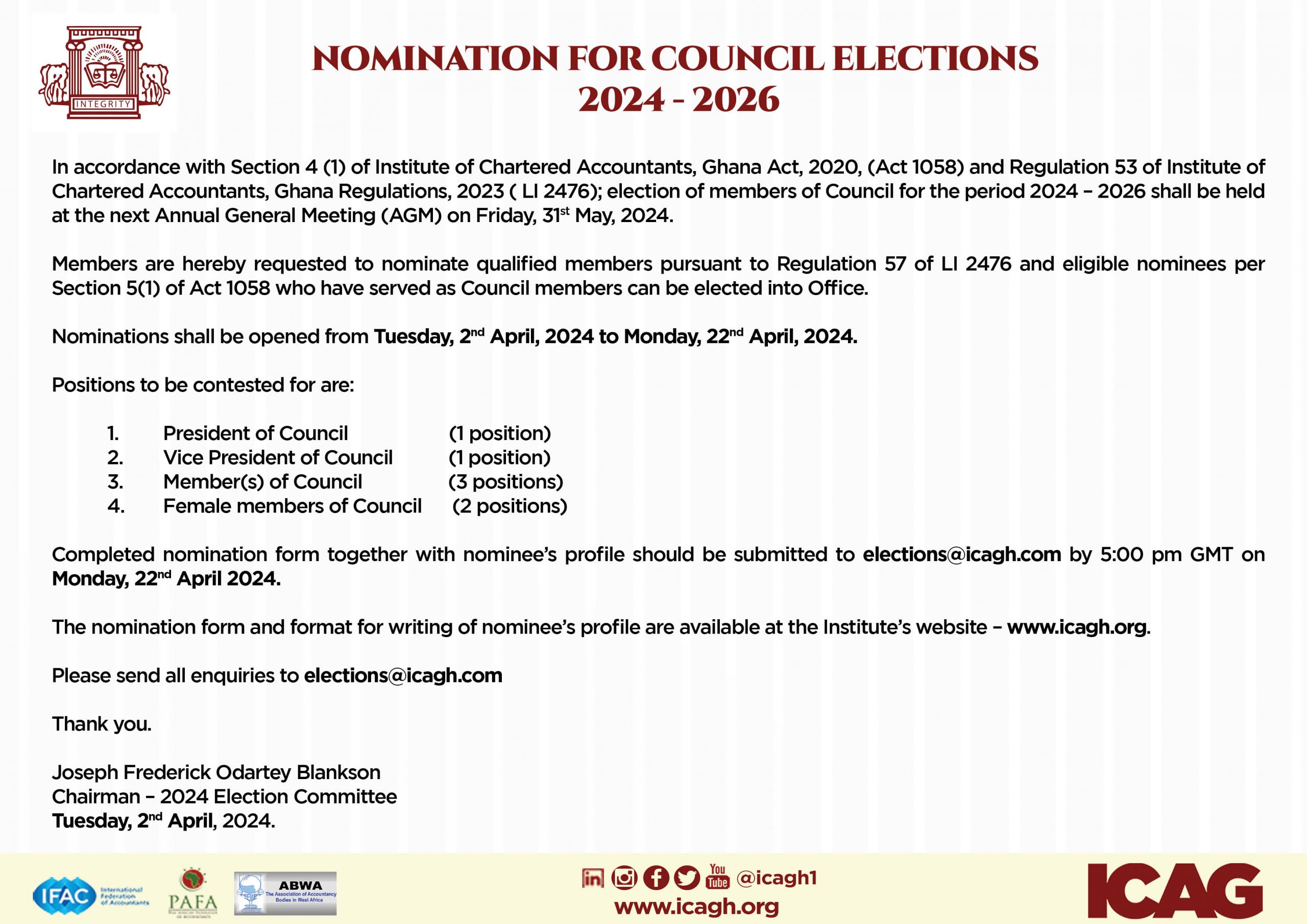

News Flash :